July 9, 2024

2024 Mid-Year Update

The first half of 2024 continued the positive momentum seen in 2023 across financial markets. The likelihood of a recession has diminished compared to a year ago. Meanwhile, a stronger-than-expected labor market and stalled progress on inflation have created a challenging environment for Fed policymakers. Looking ahead to the second half of the year, monetary policy remains in focus as the upcoming US presidential election is sure to dominate the headlines.

A Healthy Start

At our client seminars to start 2024, we said we hoped for a “normal” year after five consecutive calendar years with global stocks rising or falling by more than 15%. Well, the first half of 2024 has been a little better than normal for stocks and a little worse than normal for bonds.

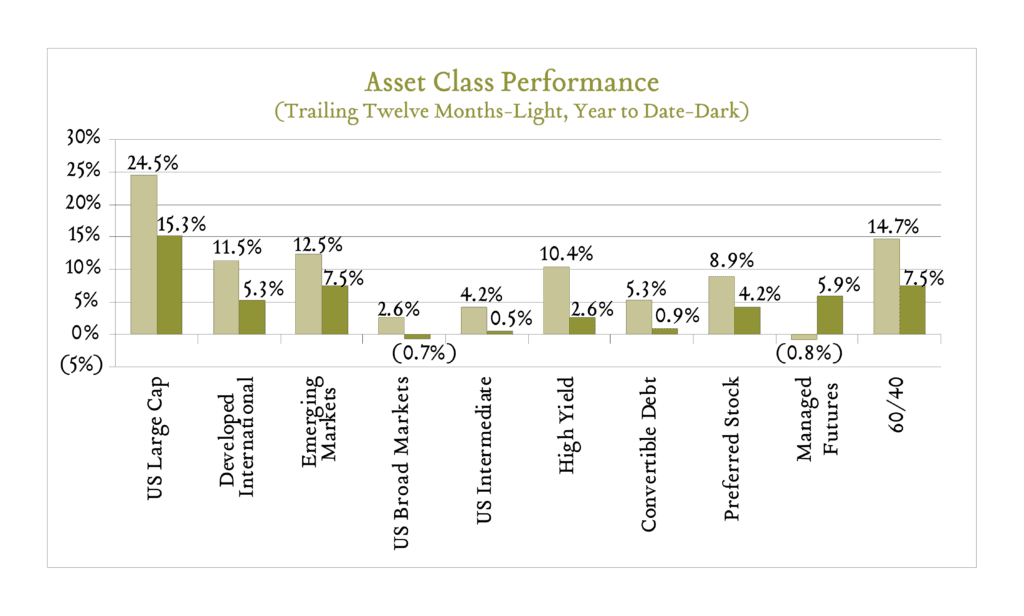

Year-to-date, global equities are up more than 12%. Domestic large caps are up 14.4%, while developed international and emerging market stocks are up 5.3% and 7.5%, respectively. At the same time, core bonds are up 0.5% and the 10-year Treasury bond rate has risen to 4.40% compared to 3.88% starting the year. Even a balanced portfolio composed of 60% stocks and 40% bonds is up 7.5% in the first six months of the year.

Labor Market Cooling but Solid

Job openings have continued to trend lower in 2024. Through April, open positions declined to 8.1M, down from 8.9M starting the year and a peak of 12.2M in March of 2022. More importantly, the ratio of job openings to unemployed workers now stands at 1.2:1, down from a peak of 2:1. Declining job openings indicate the labor market is coming into better balance, a positive development for policymakers focused on bringing inflation back to targeted levels because it lessens the chance of a harmful wage-price spiral. That said, the labor market remains strong. Monthly payroll additions averaged 250K in the first half of the year, consistent with full year 2023 levels. Year-to-date, the unemployment rate has moved 0.3% higher to 4.0%, but remains quite low by historical standards.

Inflation Range-Bound?

Despite a gradually cooling labor market, inflation, as measured by yearly changes in the Consumer Price Index (CPI), has been stuck between 3.1% and 3.5% year-to-date. That’s down from an average of 4.1% in 2023 and a peak of 9.1% in June of 2022, but still higher than Fed Policymakers (and consumers) would like. Although the CPI index generates more headlines, the FOMC uses the Personal Consumption Expenditures (PCE) index when gauging its 2% inflation target. PCE has ranged from 2.5% to 2.7% year-to-date. May PCE showed a 2.6% increase in prices, compared with 2.7% in April.

A Patient Fed

The Federal Reserve is charged with maintaining a very delicate balance with a very blunt set of tools. We all want to see inflation return to 2% swiftly, which could be easily achieved if we were all also on board with crashing the labor market to achieve it. The goal of restrictive monetary policy is to gradually slow economic activity to bring inflation back to targeted levels without slowing so much as to risk sending the economy into a recession. After reaching what appears to be a peak policy rate level of 5.25%-5.50% in July 2023, Fed policymakers have not been in a hurry to cut rates. Their patience has been bolstered by the strong labor market and stubborn inflation. The bond market has been less patient and it’s easy to forget that just six months ago, investors were pricing for six rate cuts in 2024. With four meetings left this year, investors are now pricing for just two cuts, while Fed projections from June indicate just one cut.

Election Year

US federal elections are slated for Tuesday, November 5, 2024. Both polls and prediction markets indicate that the presidential contest is currently too close to call. We recommend clients be wary of headlines suggesting one candidate or the other will help or harm the stock market. Historically, U.S. stocks have performed well under both Republican and Democratic administrations, including both Presidents Biden and Trump. The fact that an election is on the horizon has not historically been a good reason to trim equities. On average, S&P 500 returns have been positive in:

- The fourth year of a Presidential term

- The fourth year of a Democrat’s term

- The fourth year of a Republican’s term

- In the year prior to a Democrat being elected

- In the year prior to a Republican being elected

- During the period between the election and inauguration, and

- In the first year of a new President’s term

- Today’s political climate is polarizing for a number of reasons, but reading this list, anticipated stock market performance really shouldn’t be one of them.

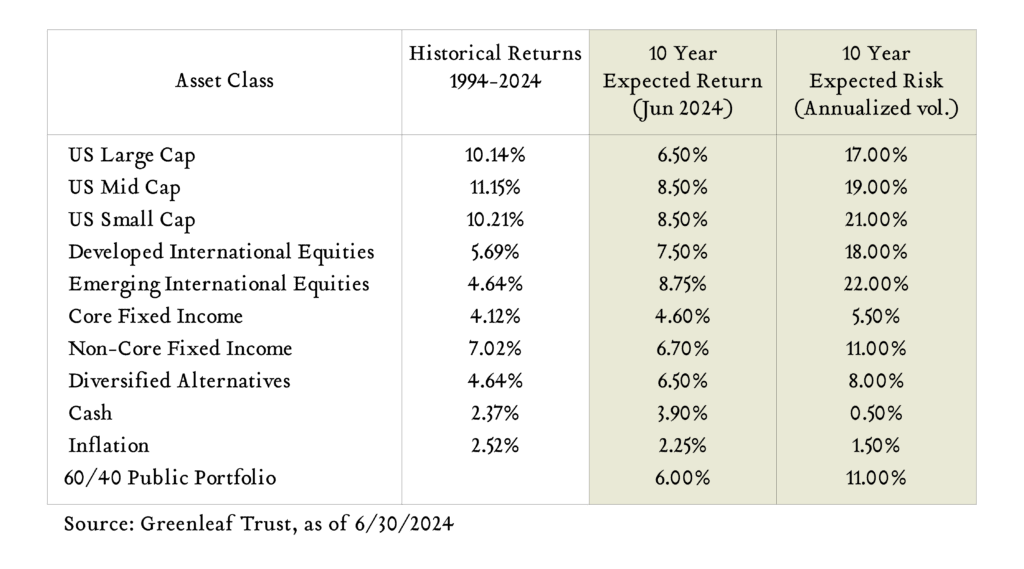

Looking Forward – Capital Market Assumptions

As for the market experience going forward, we share our updated capital market assumptions below. These forecasts represent our expectations for average annualized returns for each asset class over the next ten years. Over the next decade, there will be years where returns exceed our expectations and years where returns trail our expectations. We believe short-term market-timing strategies are unlikely to improve long-term outcomes.

We continue to recommend most of our clients hold a full weight to global equities in accordance with their individualized risk profile, and we remain marginally more constructive on international equities. Concurrently, in this relatively uncertain environment, we are utilizing diversifying strategies (alternative assets) that can access return drivers uncorrelated with traditional stock and bond markets.

Despite an ever-changing landscape, our disciplined approach and long-term orientation serve us well as we endeavor to create comprehensive investment solutions that help our clients reach their financial goals. On behalf of the entire team, thank you for allowing us to serve on your behalf and good luck in the second half of the year.