May 16, 2024

April Retail Sales - Consumers Take a Breather

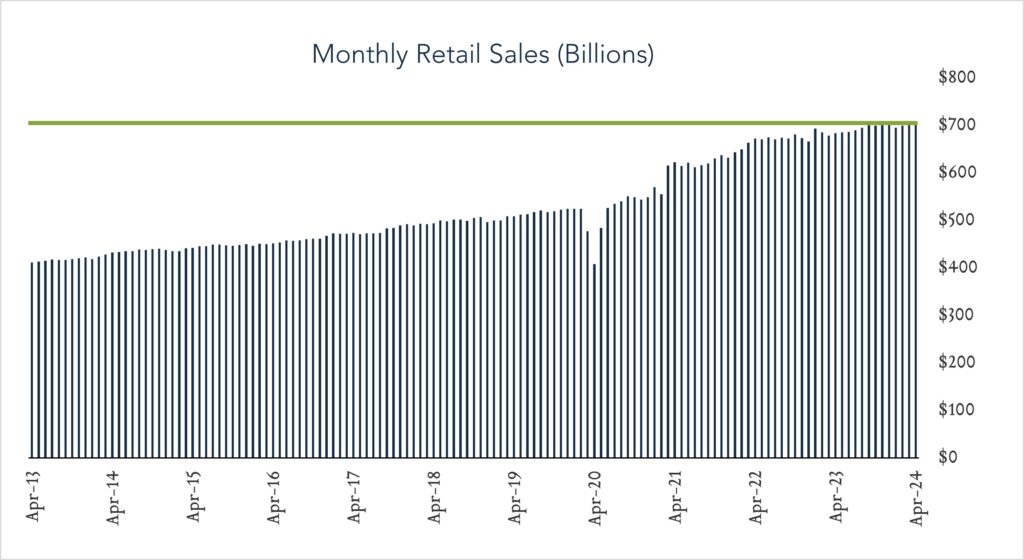

U.S. retail sales stalled in April after downwardly revised gains in the February and March. It appears that higher prices and more limited access to credit are driving more limited discretionary spending levels. This is consistent with first quarter commentary from several major retailers including Amazon, Starbucks, and McDonalds. While Fed projections (provided in March) call for three 0.25% rate cuts this year, commentary out of the most recent FOMC meeting indicated the prospect for cuts would be based on incoming data that supports higher confidence that either supports higher confidence that inflation is decelerating or highlights unexpected weakness in the economy. Today’s report, coupled with softer April jobs data and indications that inflationary pressures are subsiding likely tilts the calculus in favor of more accommodation from the Fed. Following the report, investors repriced expectations to reflect two cuts in 2024, up from one to two cuts previously.

- Real (inflation adjusted) retail sales declined 0.4% year-over-year. In April, retail sales grew 3.0% nominally netting a decline of 0.4% after adjusting for 3.4% inflation. Healthy spending at online retailers (+7.5%) and on restaurant dining (+5.5%) was partially offset by lower spending on building materials (-1.0%) and home furnishings (-8.4%). Eight out of thirteen categories slowed in real terms.

- Real (inflation adjusted) retail sales declined 0.3% month-over-month. In April, nominal retail sales levels were unchanged compared to March (consensus +0.4%) netting a 0.3% decline in real terms. Increased spending at gas stations (+3.1%) and clothing stores (+1.6%) was offset by lower spending online (-1.2%) and on motor vehicles (-0.8%). Eight out of thirteen categories slowed in real terms.