August 10, 2023

July Inflation - Better Than Expected

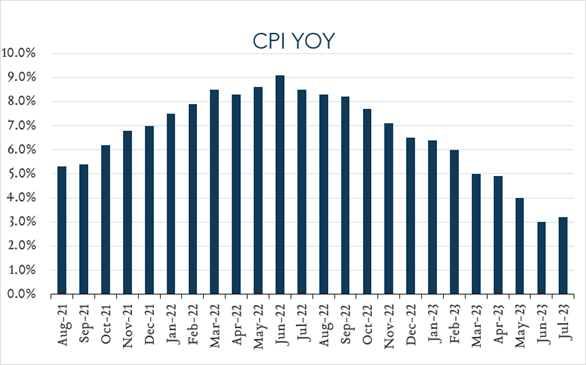

On a year-over-year basis, July inflation data showed overall annualized price increases accelerated slightly to 3.3% (from 3.0% in June) largely owing to base effects of a tougher prior-year compare as peak inflation levels of 9.1% recorded in June 2022 have now annualized. Cooling inflation alongside solid economic growth and a healthy but gradually normalizing labor market represent a welcome scenario for Fed policymakers. The fastest hiking cycle in over 30 years has moved interest rates to their highest levels in more than two decades, helping to ease inflationary pressures, but so far without tipping the economy into a recession – an outcome once assumed to be an inevitability. Today’s report is just one of a number of key data releases policymakers will have in hand ahead of their September meeting. Should current trends continue, it’s possible the Fed could leave rates unchanged next month.

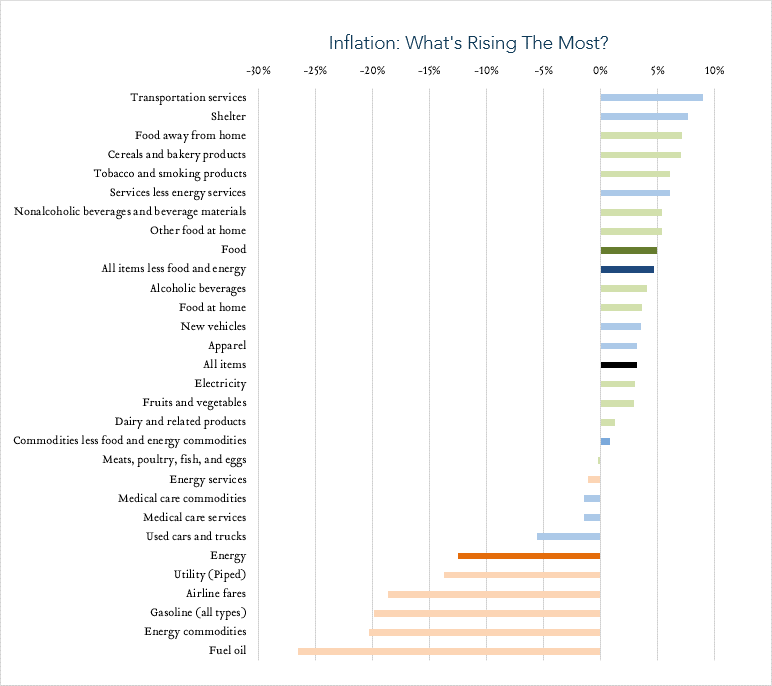

- Consumer prices (CPI) increased 3.2% year-over-year. In July, the consumer price index (CPI) increased 3.2%, up slightly from 3.0% in June, but slightly below expectations of 3.3%. The uptick primarily reflects base effects of a year ago now that the peak of 9.1% (June 2023) has annualized. Transportation services (+9.0%), shelter costs (+7.7%), and food (+4.9%) were key contributors to the overall increase, more than offsetting declines in energy (-12.5%; including gasoline -19.9%) and used vehicles (-5.6%). We continue to keep a close eye on shelter costs, which represent nearly one third of the consumer price index and tend to impact the index with a lag. At +7.7% year-over-year, shelter costs decelerated from +7.8% in June and a peak of 8.2% in March 2023. Core CPI (excludes food and energy) increased 4.7% year-over-year, down from 4.8% in June and in line with expectations.

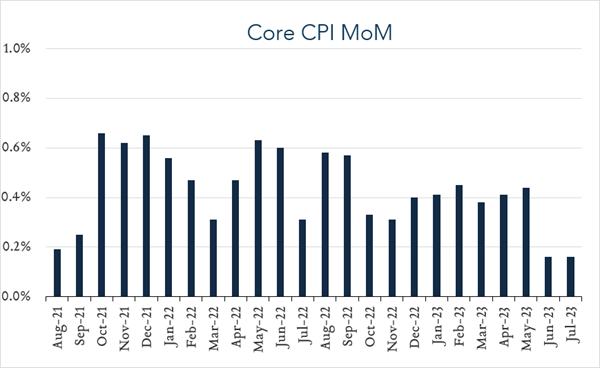

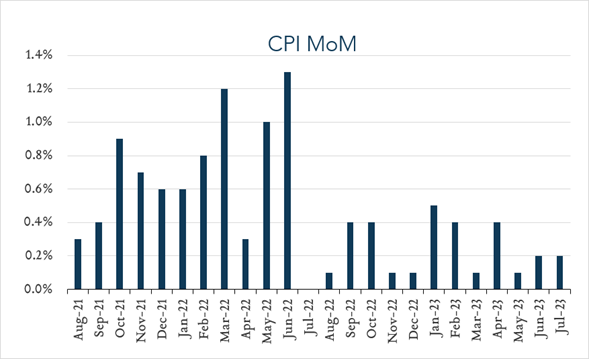

- Consumer prices (CPI) increased 0.2% month-over-month. In July, consumer prices rose 0.2% compared to June. Expectations ranged from +0.1% to +0.5% with a median of +0.2%. Prices for used cars and trucks declined 1.3% while shelter costs, which represent nearly one-third of the index, increased 0.4% for the month and remained the largest contributor to the overall outcome. Core CPI (excludes food and energy) also increased 0.2% compared to a month ago, unchanged from June and in line with expectations.