July 26, 2023

Fed Raises 0.25% as Expected; Keeps Options Open

Fed Statement Side-by-Side: Review the Fed’s statement changes

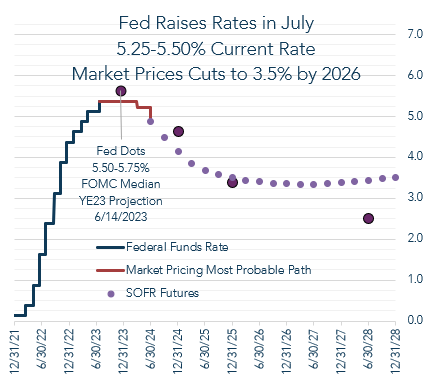

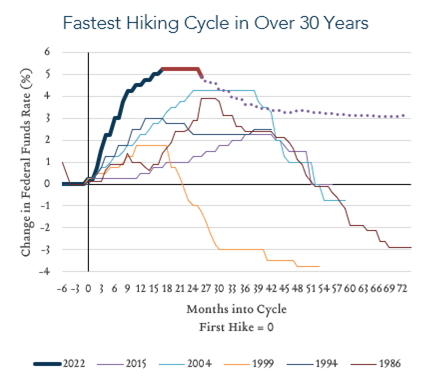

Fed raises interest rates by 0.25%, bringing the Fed Funds Rate range to 5.25-5.50% – the highest level in 22 years. The committee left the door open to additional increases as policymakers continue their efforts to quell inflation.

Key takeaways:

- The Fed unanimously voted to raise interest rates 0.25%, as expected, to a range of 5.25-5.50%.

- Median FOMC projections (provided in June) call for one additional 0.25% increase this year, though markets are pricing in 50/50 odds of that happening with cuts priced in for early 2024.

- The Fed’s statement, largely unchanged from June, emphasized that future policy changes will be data-dependent, taking into account:

- The cumulative tightening of monetary policy

- The lags with which monetary policy affects economic activity and inflation

- Other economic and financial developments

- This approach suggests policymakers are keeping options open to potentially hike again in September, pause, or forego an additional increase depending on incoming data.

- Said another way, the September meeting is live and could be pretty exciting – as far as Fed meetings go.

Messaging at the press conference:

- Powell’s characterization of the economy did not change significantly from the June meeting. He emphasized:

- The economy continues to expand at a “moderate” pace.

- The housing sector has picked up slightly, but remains softer than a year ago.

- The labor market remains very tight but is showing some signs of coming into better balance:

- Nominal wage growth is slowing.

- Job vacancies are declining.

- Powell characterized the impacts of policy tightening as already affecting the most interest rate sensitive sectors of the economy, but reiterated that it would take time for the full impact to be felt through the broader economy and to impact inflation.

- Ultimately, reducing inflation will require a period of below trend growth and softening of labor market conditions.

- Going forward, decisions will be made on a meeting-by-meeting basis and the Fed is prepared to do more.

Market reaction:

The market was slightly lower before the statement and moved into positive territory during the press conference.

Yields were mostly stable today, rising slightly throughout the day and reaching session lows during the press conference.

The dollar is slightly weaker. Gold is up. Oil is down.

| Prev. Close | Open | 2pm | 2:45pm | % change Prev Close | % change Open | % change 2pm-2:45pm | ||

| S&P 500 | $ 4,567.46 | $ 4,558.96 | $ 4,558.55 | $ 4,577.23 | 0.21% | 0.40% | 0.41% | |

| Dow Jones Industrial Average | $ 35,438.07 | $ 35,345.99 | $ 35,465.21 | $ 35,590.51 | 0.43% | 0.69% | 0.35% | |

| Nasdaq | $ 14,144.56 | $ 14,123.52 | $ 14,095.15 | $ 14,149.45 | 0.03% | 0.18% | 0.39% | |

| 10 Year Treasury Rate (%) | 3.88% | 3.89% | 3.88% | 3.86% | -0.02% | -0.03% | -0.02% | |

| US Dollar | $ 101.35 | $ 101.32 | $ 101.20 | $ 101.02 | -0.33% | -0.30% | -0.17% | |

| Gold | $ 1,964.96 | $ 1,964.96 | $ 1,970.91 | $ 1,974.89 | 0.51% | 0.51% | 0.20% | |

| Oil | $ 79.63 | $ 79.34 | $ 79.03 | $ 78.86 | -0.97% | -0.60% | -0.22% |