March 23, 2023

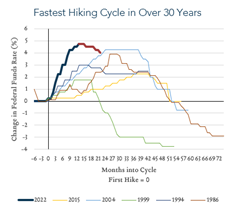

Fed Raises 0.25%; Signals Hiking Cycle Close to Over

Fed raises interest rates by 0.25%, bringing the Fed Funds Rate range to 4.75-5.00%. It maintained projections for a year-end 2023 top rate of 5.25% – implying one additional 0.25% increase this year.

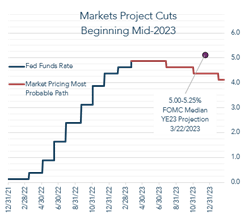

The market remains lower than the fed, pricing for a terminal rate consistent with today’s increase and pricing for 75bps of cuts in late 2023 & early 2024.

Key takeaways:

- The Fed raised interest rates 0.25%, as expected, to a range of 4.75-5.00%.

- Projections for the 2023 year-end rate was unchanged at 5.00-5.25%, with 0.75% of cuts projected in 2024.

- The bond market continues to price in a high-point of 4.75-5.00% followed by 0.75% in cuts beginning later this year.

- Chair Powell stated that the U.S. banking system is “sound and resilient” noting that recent developments are likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation.

At its meeting today the FOMC voted unanimously to raise the Federal Funds rate to 4.75-5.00% and to continue its quantitative tightening plan.

With the exception of mentioning recent developments in the banking industry, the statement was largely unchanged from February.

In its summary of economic projections, the Fed updated projections to show slower real GDP growth in 2023 and 2024, slightly lower unemployment in 2023, and slightly faster 2023 inflation.

The 2023 forecast continues to show Core PCE Inflation exceeding headline PCE inflation, reflecting inflation broadening into stickier areas of the economy.

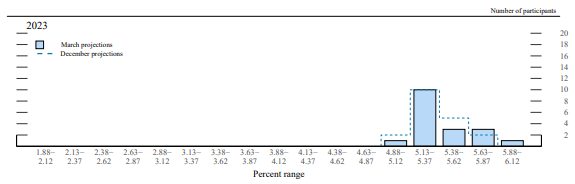

The Summary of Economic Projections showed the following changes to the median Fed Funds Target Rate forecast:

By year-end 2023: 5.1% (no change)

By year-end 2024: from 4.1% to 4.3%

| Variable | ||||

| 2023 | 2024 | 2025 | Longer Run | |

| Change in real GDP | 0.4 | 1.2 | 1.9 | 1.8 |

| December projection | 0.5 | 1.6 | 1.8 | 1.8 |

| September projection | 1.2 | 1.7 | 1.8 | 1.8 |

| June projection | 1.7 | 1.9 | 1.8 | |

| Unemployment rate | 4.5 | 4.6 | 4.6 | 4.0 |

| December projection | 4.6 | 4.6 | 4.5 | 4.0 |

| September projection | 4.4 | 4.4 | 4.3 | 4.0 |

| June projection | 3.9 | 4.1 | 4.0 | |

| PCE inflation | 3.3 | 2.5 | 2.1 | 2.0 |

| December projection | 3.1 | 2.5 | 2.1 | 2.0 |

| September projection | 2.8 | 2.3 | 2 | 2.0 |

| June projection | 2.6 | 2.2 | 2.0 | |

| Core PCE inflation | 3.6 | 2.6 | 2.1 | |

| December projection | 3.5 | 2.5 | 2.1 | |

| September projection | 3.1 | 2.3 | 2.1 | |

| June projection | 2.7 | 2.3 | ||

| Fed funds rate | 5.1 | 4.3 | 3.1 | 2.5 |

| December projection | 5.1 | 4.1 | 3.1 | 2.5 |

| September projection | 4.6 | 3.9 | 2.9 | 2.5 |

| June projection | 3.8 | 3.4 | 2.5 | |

2023 Year End Dot Plot Evolution (little changed from December):

Messaging at the press conference:

While much has changed since the February meeting and the Committee’s last statement of economic projections (released in December), Chair Powell noted offsetting/conflicting factors that left projections largely unchanged.

Chair Powell characterized the events of the last two weeks (bank failures etc.) as equivalent to an additional rate increase as they are likely to result in tighter credit conditions and to weigh on economic activity, hiring, and inflation. As this is consistent with the intentions behind tighter monetary policy, the implication is that policy tools may have less work to do from here.

Market reaction:

The market was up for most of the morning, held firm on the release of the statement but moved lower late in the press conference.

The bond market continues to expect lower policy rates than the Fed is projecting, with yields moving lower.

The dollar weakened. Gold and oil moved higher.

| Prev. Close | Open | 2pm | 2:45pm | % change Prev Close | % change Open | % change 2pm-2:45pm | ||

| S&P 500 | $ 4,002.87 | $ 4,002.04 | $ 4,017.93 | $ 4,024.98 | 0.55% | 0.57% | 0.18% | |

| Dow Jones Industrial Average | $ 32,560.60 | $ 32,570.19 | $ 32,611.21 | $ 32,712.26 | 0.47% | 0.44% | 0.31% | |

| Nasdaq | $ 11,860.11 | $ 11,857.50 | $ 11,934.38 | $ 11,994.46 | 1.13% | 1.16% | 0.50% | |

| 10 Year Treasury Rate (%) | 3.61% | 3.61% | 3.51% | 3.46% | -0.15% | -0.15% | -0.05% | |

| US Dollar | $ 103.26 | $ 103.19 | $ 102.57 | $ 102.10 | -1.12% | -1.06% | -0.46% | |

| Gold | $ 1,940.07 | $ 1,940.07 | $ 1,963.80 | $ 1,975.56 | 1.83% | 1.83% | 0.60% | |

| Oil | $ 69.67 | $ 69.48 | $ 70.86 | $ 71.17 | 2.15% | 2.43% | 0.44% |