February 1, 2023

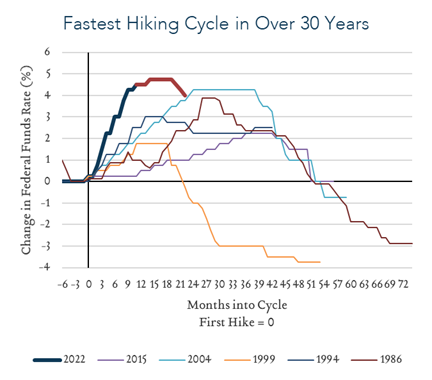

Fed Raises 0.25%, as Expected; Commentary Well Received

Fed Statement Side-by-Side: https://file.ac/QIEfaKSk2vI/

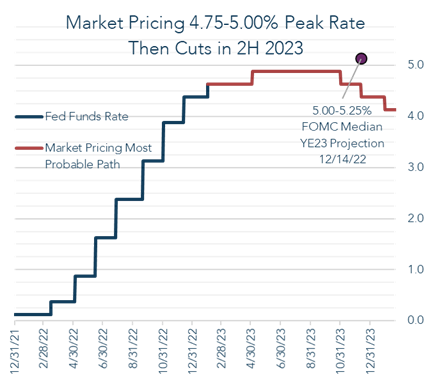

Fed raises interest rates by 0.25%, bringing the Fed Funds Rate range to 4.50-4.75%. The market is now lower than the fed, pricing for a terminal rate of 4.75-5.00% before 75-100 bps of cuts in late 2023 & early 2024.

Key takeaways:

- The Fed raised interest rates 0.25%, as expected, to a range of 4.50-4.75%.

- The bond market continues to price in a high-point of 4.75-5.00% followed by 0.75% to 1.00% of cuts by early 2024.

- Chair Powell noted that the disinflationary process appears to be underway, but characterized the evidence as insufficient to pause the current hiking cycle.

- Again, Powell focused on inflationary signals in non-housing services as necessitating further rate increases.

- i.e. transportation services (airfare), food service (restaurants), recreation services (health clubs, gyms).

The statement noted that inflation has eased somewhat and removed language about the Russian invasion of Ukraine contributing to elevated prices.

Messaging at the press conference:

We received job openings data this morning and it surprised to the upside, with 11 million job openings when economists were expecting about 700k fewer openings.

For the 2nd consecutive meeting, Powell spent a lot of time focused on Core Services Ex-Housing. He noted:

- Goods, 25% of Core PCE – seeing progress, expected this to be temporary and due to supply chains.

- Housing Services, 25% of Core PCE – disinflation in the pipeline, but not currently in the calculated numbers

Core Services Ex-Housing, 50% of Core PCE – 7 or 8 services, not all the same, the biggest part of it is sensitive to slack in the economy, including in the labor market.

These include Health Care, Transportation Services, Recreation Services, Food Service & Accommodations, Financial Services & Insurance, and Other Services.

Not seeing inflation moving down yet here, and we need to see it. Until we do, we see ourselves as having more persistent inflation here and taking longer to get down.

Powell believes transitory goods price decreases are currently keeping Core PCE lower, and that the current rate appears to be around 4%.

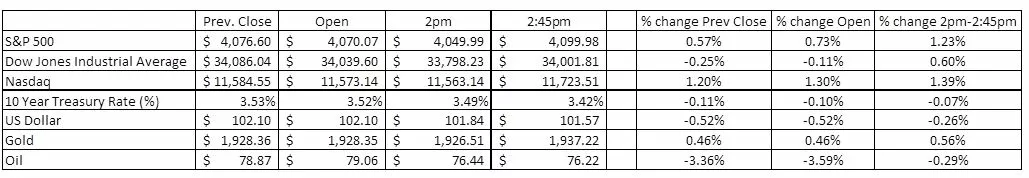

Market reaction:

The market was trending lower throughout the day until 2pm on the release of the statement. Stocks whipsawed during introductory comments, but moved higher during Q&A.

Yields were falling throughout the day with the 10 year at around 3.55 at 8am and dipping down to 3.47 by 2pm. Yields fell further during the conference to 3.4%.

The dollar weakened. Gold rose. Oil is falling today.