January 6, 2023

December Jobs - Solid Hiring; Wages Cool

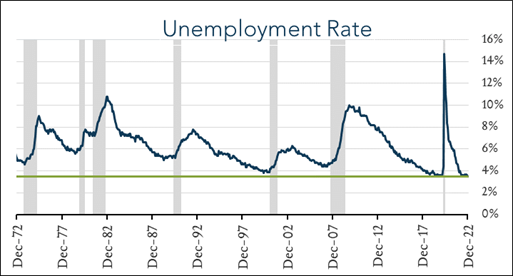

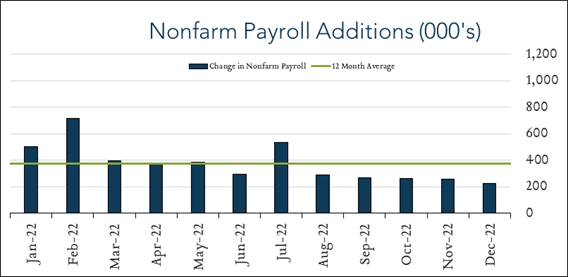

Solid hiring and decelerating wage growth may offer Fed some breathing room. U.S. employers again added more jobs than expected in December and the unemployment rate edged lower while wage growth decelerated more than expected and participation increased slightly. Today’s report highlights resiliency of the labor market, but may also be an early indication that the persistent imbalance between the supply and demand for labor is beginning to unwind. A sustained deceleration in wage growth could lead Fed officials to pursue less aggressive policy moves in the coming months.

- 223K jobs added in December – stronger than expected once again. The U.S. labor market added 223k jobs in December compared to forecasts ranging from +70K to +350K with a median of +203K. December marked the smallest number of monthly job gains in 2022 and compared to a prior 3-month average of +262K and a full year average of +375K. Notable payroll additions were evident in Leisure & Hospitality (+67K), Health Care (+55K) and construction (+28K). Most other sectors posted modest gains or were essentially unchanged.

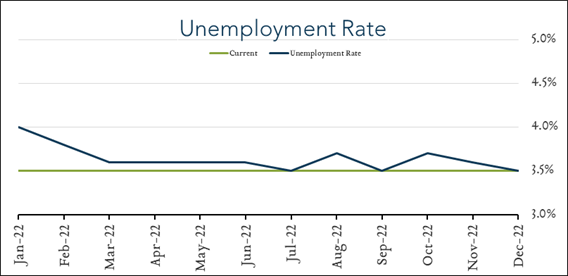

- 3.5% unemployment – better than expected. The U.S. unemployment rate ticked down to 3.5% in December from 3.6% (revised) last month. Forecasts ranged from 3.5% to 3.8% with a median of 3.7%. The labor force participation rate increased slightly to 62.3% but remained largely consistent with the 2022 average. Hourly earnings increased less than expected rising 4.6% over the last year (compared to expectations of +5.0%) and 0.3% month-over-month (compared to expectations of +0.4%).